If you have access to online banking, you can download the bank statements when conducting a bank reconciliation at regular intervals rather than manually entering the information. When all these adjustments have been made to the books of accounts, the balance as per the cash book must match that of the passbook. If both the balances are equal, it means the bank reconciliation statement has been prepared correctly. As a result, the bank statement balance will be lower than the cash book balance, so the difference will need to be adjusted in your cash book before preparing the bank reconciliation statement. Accurate cash flow is essential for keeping a business running smoothly, so it’s important to be aware of all incoming and outgoing cash. A bank reconciliation is the process by which a company compares its internal financial statements to its bank statements to catch any discrepancies and gain a clear picture of its real cash flow.

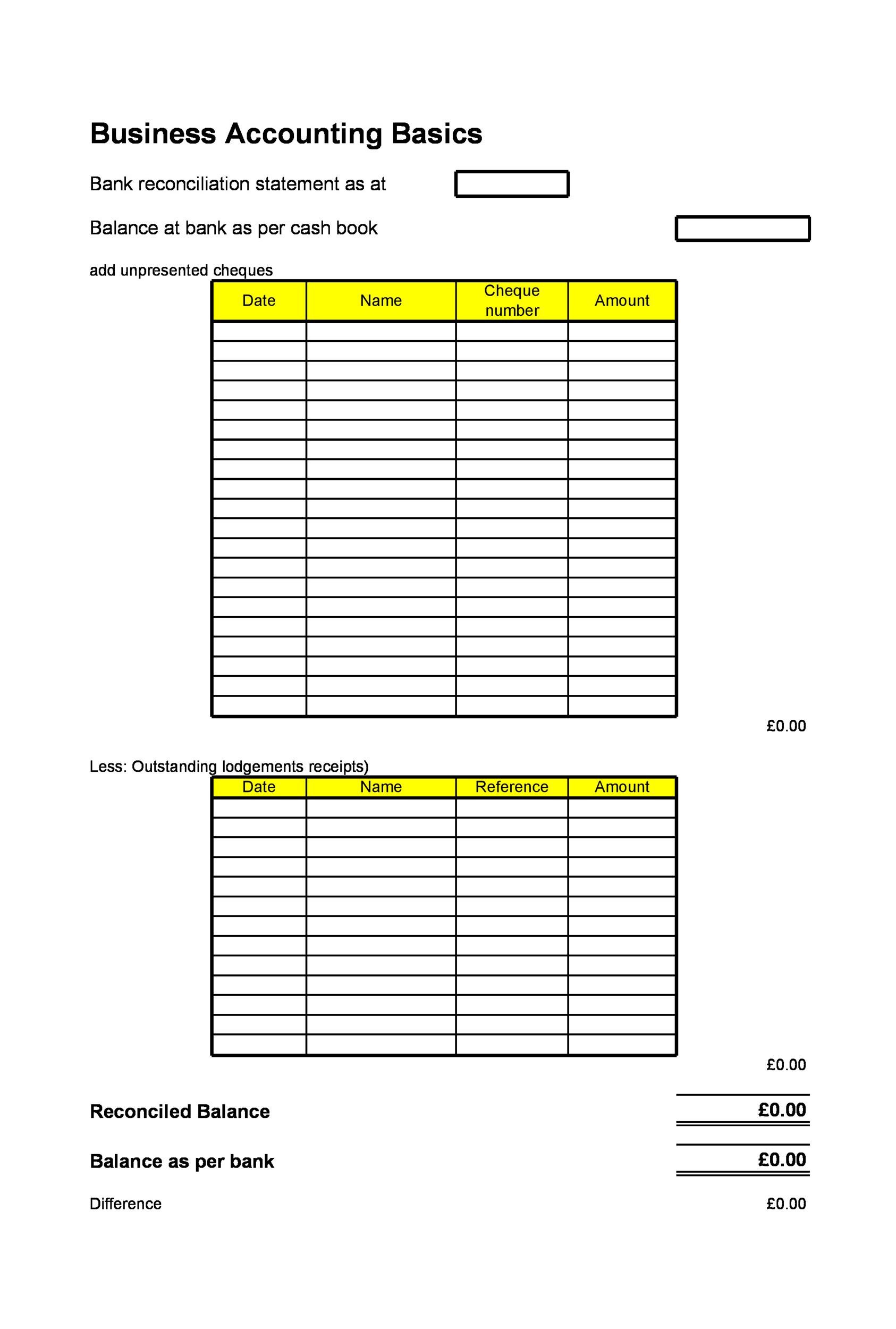

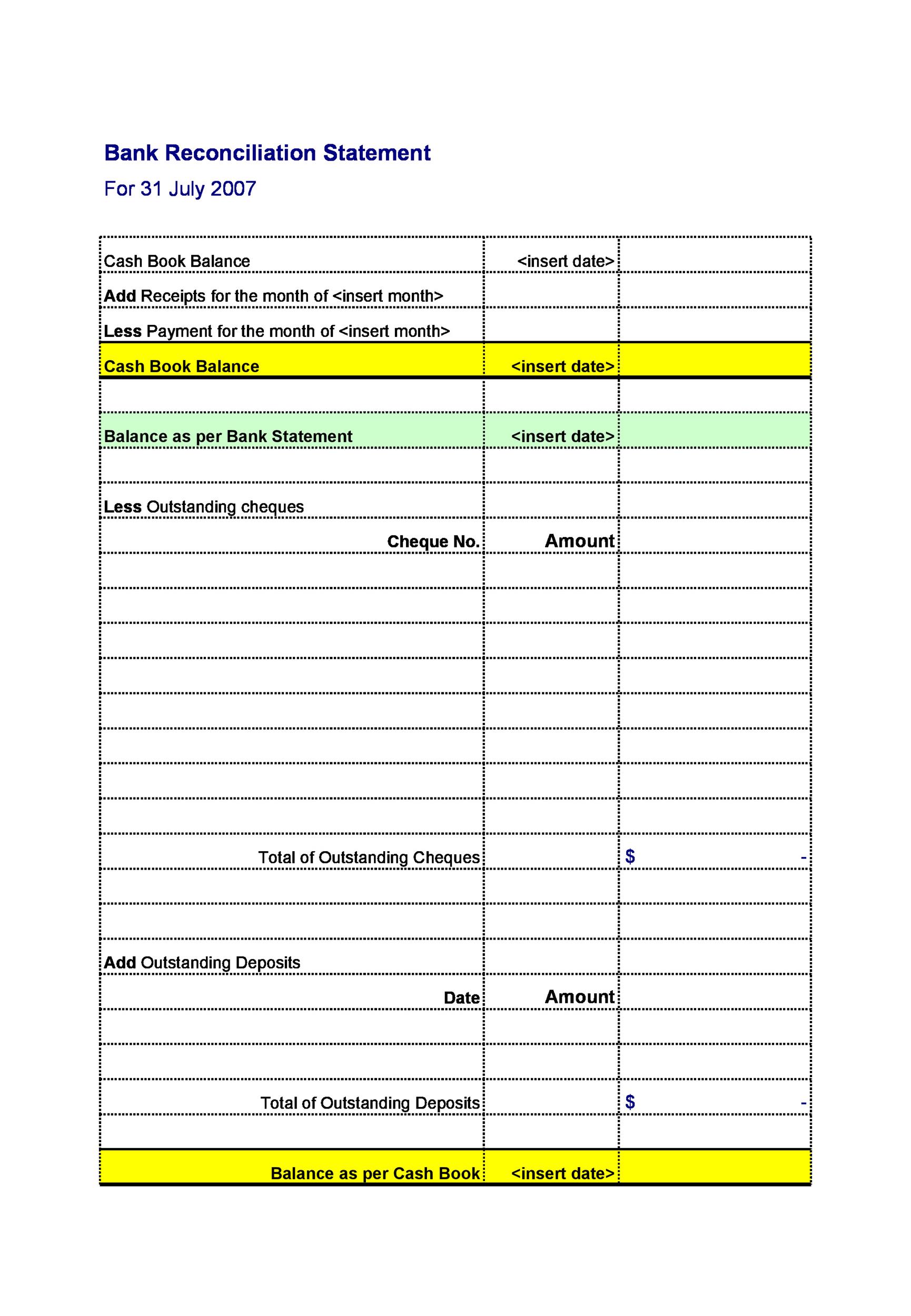

Step 2 – Find outstanding/unpresented checks and deduct from bank statement balance:

Deposits in transit are amounts that are received and recorded by the business but are not yet recorded by the bank. Yes, examples and solutions for bank reconciliation are available online and in accounting textbooks. how to file your federal taxes It is recommended to seek guidance from a qualified accountant or bookkeeper to ensure accuracy. When the bank pays out cash against that cheque, it records the payment on the debit column of his statement of account.

- The items in the bank section show that the bank’s version does not agree with the books because a deposit had not been processed and the checks had not yet been canceled.

- Performing immediate bank reconciliations for large cash amounts or suspicious transactions further increases your ability to catch fraud and error.

- If you find any errors or omissions, determine what happened to cause the differences and work to fix them in your records.

- Deposits in transit, or outstanding deposits, are not showcased in the bank statement on the reconciliation date.

- Many banks allow you to opt for fee-free electronic bank statements delivered to your email, but your bank may mail paper bank statements for a fee.

- These time delays are responsible for the differences that arise in your cash book balance and your passbook balance.

Compare the Balances

In this case, the bank hasn’t honored it due to insufficient funds from an entity’s account. That means it hasn’t been reflected in the bank statements, yet it’s recorded in your cash book, so you need to deduct it from your records. How you choose to perform a bank reconciliation depends on how you track your money.

Electronic bank reconciliation

Consider reconciling your bank account monthly, whether you set aside a specific day each month or do it as your statements arrive. The final step of a bank reconciliation process is to prepare appropriate journal entries for the items that are causing the difference because you have not yet recorded them in your accounting record. You entered it immediately in your accounting records and deposited the the check into your account. After depositing the check, your bank immediately credited your account by $1000.

This document can help ensure that your bank account has a sufficient balance to cover company expenses. It’s a tool for understanding your company’s cash flow and managing accounts payable and receivable. If you haven’t been using bank reconciliation statements, now is the best time to start. A bank reconciliation statement is a summary that shows the process of reconciling an organization’s bank account records with the bank statement. It lists the items that make up the differences between the bank statement balance and the accounting system balance, and explains how these differences were resolved. The cash account balance in an entity’s financial records may also require adjusting in some specific circumstances, if you find discrepancies with the bank statement.

Step 4: Make Sure the Balance As Per the Bank Matches the Balance As Per the Cash Book

Balance, the last column shows ‘Cr.’ Alternatively, if the balance is a Dr. balance, the last column shows ‘Dr.’ An example of a typical bank statement is shown below. Customer check of $1,250 deposited by Company A has been returned and charged back as NSF (not sufficient funds). Chartered accountant Michael Brown is the founder and CEO of Double Entry Bookkeeping. He has worked as an accountant and consultant for more than 25 years and has built financial models for all types of industries. He has been the CFO or controller of both small and medium sized companies and has run small businesses of his own.

(c) A deposit of $5,000 received by the bank (and entered in the bank statement) on 28 May does not appear in the cash book. Hence, at the end of each month, the first thing to do is to consult the bank reconciliation statement prepared at the end of the previous month. One of the procedures for establishing the correct cash balance (and for controlling cash) is the reconciliation of the bank and book cash balances.

So, to reconcile the amounts, you simply add the additions (interest income) and subtract the subtractions (bank charges and overdraft fees) to reach the bank balance. Ideally, the balance in your books is the same as the closing bank balance. During September, the company received $120,000 from sales and invoiced debtors $40,000 the previous month, and received a check that has not yet been reflected in the bank account. Paystand is on a mission to create a more open financial system,starting with B2B payments. Using blockchain and cloud technology, wepioneered Payments-as-a-Service to digitize and automate your entire cashlifecycle.

We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. Nevertheless, on 5 June, when the bank pays the check, the difference will cease to exist. Therefore, such adjustment procedures help in determining the balance as per the bank that will go into the balance sheet. The items shown in the book section arise from the previously unknown events.

This often happens when the checks are written in the last few days of the month. When David deposits money with the bank, he makes an entry on the debit side of his cash book. Additionally, the bank records all deposits received from David in the credit column of his statement of account. This process should ensure that reconciling items relating to receipts and payments on the bank statement but not in the cash book are kept to a minimum before preparing the reconciliation statement. If you’re using accounting software, it may give you the option to connect your bank account so transactions are automatically downloaded and categorized.