This affects how much an employee gets paid for overtime and if they can get benefits. To increase billable hours, consider implementing strategies for effective time management to maximize the work you’ve currently taken on. Then, make sure to identify and leverage opportunities for billable work.One of the most important things about efficient time management is good prioritization.

Overtime

- Non-billable hours can free up time to take care of personal matters, lowering stress levels.

- Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

- Hours worked refers to all the time an employee spends performing duties and responsibilities.

- It’s important to think about the difference between tasks that can’t be billed and projects that can be billed.

Employers can approve or deny such requests based on business needs. Working less than contracted hours can lead to a proportional reduction in pay or disciplinary action, depending on your employer’s policies and the reasons for reduced hours. In the UK, working more than your contracted hours is not obligatory unless under exceptional circumstances. Employees have legal limits protected by the Working Time Regulations. Actual hours denote the number of hours an employee truly works, which may fluctuate and differ from the contracted hours.

Real-Life Examples Of When Billable Hours Are Used For Employees?

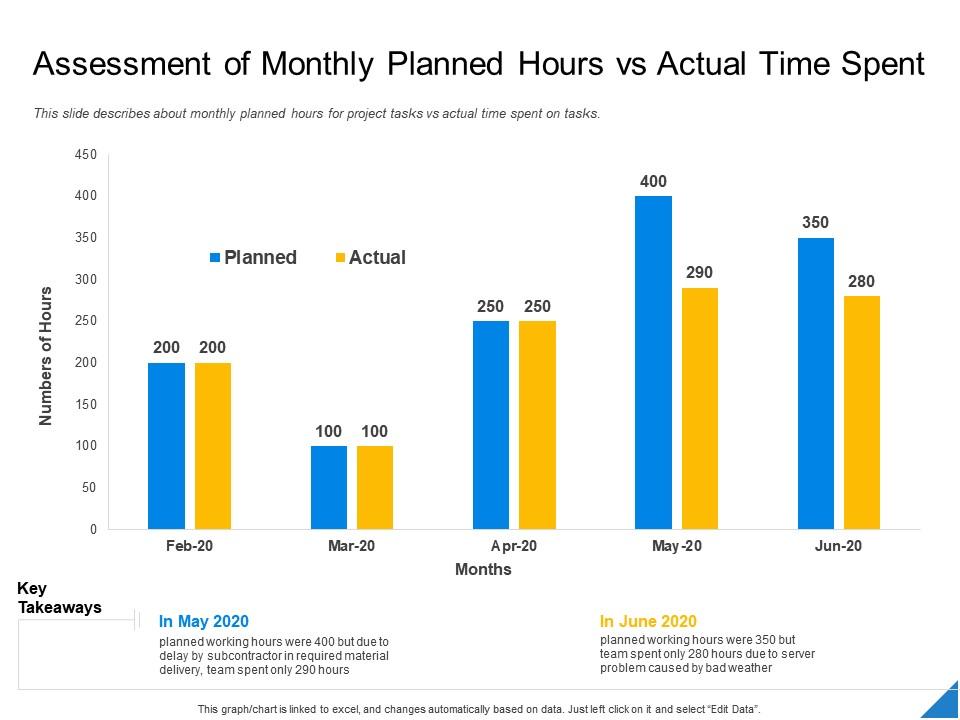

This is especially key for larger agencies managing multiple projects at once. For project managers to be able to identify key tasks, it’s important to maintain a project space that provides full visibility into current project progress and resource allocation. A higher billable-to-actual hours ratio can indicate greater revenue generation, as it means that you can fit in more client work and take direct and indirect materials cost calculation and example on more projects. Additionally, many hours spent on non-billable work can point to inefficiencies in your workflows, such as excessive time spent on administrative tasks. However, a balance between the two is necessary for managing employee workload and preventing burnout. Accountants calculate billable hours to bill clients for financial services, like preparing taxes, auditing, and consulting.

What are billable hours? Time-tracking guide and tips

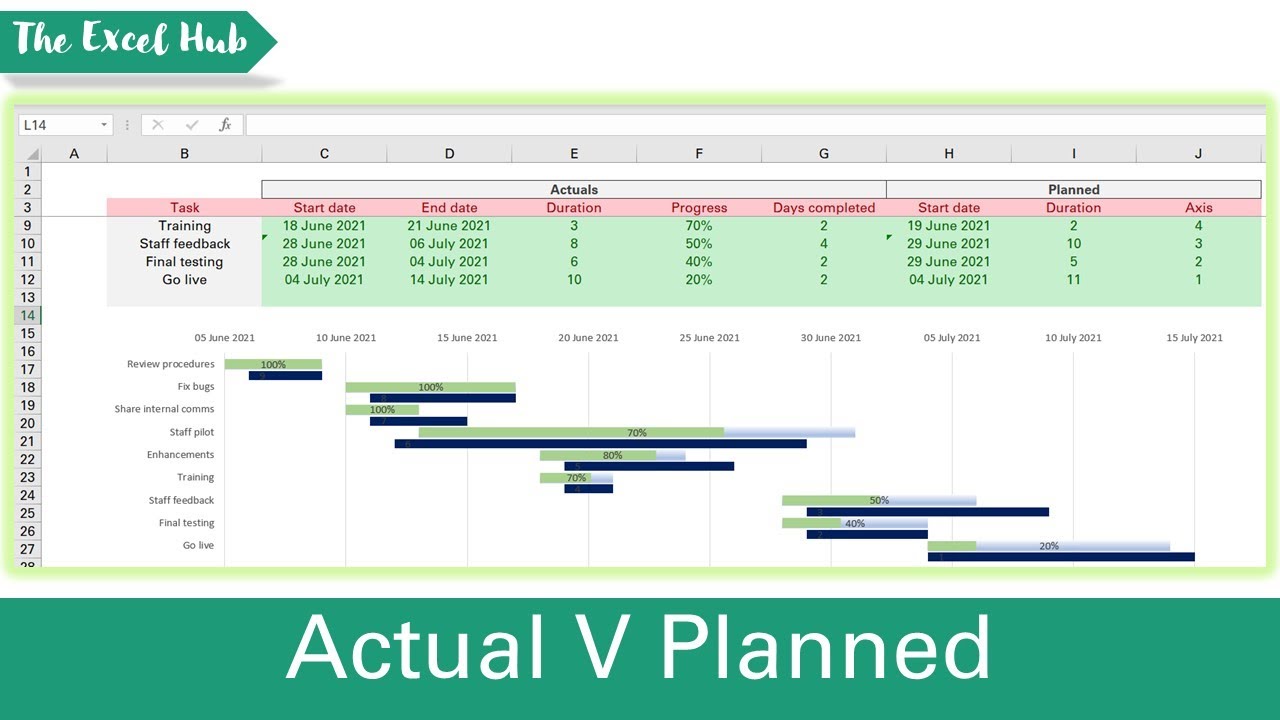

These charts break down minutes into tenths of an hour, so you can easily convert time to a decimal. Effective tracking of attendance improves productivity and helps the business focus more on work that makes money as opposed to other overheads. Using good attendance tracking and solid billing practices helps keep billing correct. Important thing to note is that good systems for tracking attendance will help give a correct view of productivity. Please note that it is important for keeping track of hours worked for clients correctly too. On the other hand, actual hours are necessary for the operation of the organization but they don’t directly generate revenue.

Determining your billable rate and salary involves a careful balance between understanding your costs, the value you provide, where you are located, and your practice’s financial goals. Attorneys often round up to the nearest allowable increment to ensure they are compensated for the total time spent on a task. For example, if a task takes 43 minutes, rounding up to the nearest tenth of an hour (0.8) is common practice rather than billing for 0.7 hours. If you bill in the standard 6-minute increments, using a billable hours conversion chart like the one below is quite helpful.

Read examples of Marketing OKRs to get a better understanding of how to get started with OKRs. Businesses often compare billable hours (chargeable to clients) to actual hours to assess productivity and profitability, reflected through metrics like the billable-to-non-billable ratio. Employers should ensure that employees understand the difference between contracted hours — the hours they are obliged to work — and actual hours — the hours they truly work. Organizations often record actual hours using timesheets or digital tracking systems. This data is essential for managing workloads, honouring employment rights, and maintaining a fair and productive workplace. If you find that actual hours exceed your earned hours week-after-week, it could be a sign that your restaurant’s forecasting is off.

Conversely, you could be safe and over-staff, then relieve workers if things slow down. There are many other software options out there, designed to aid resource and practice management. Annual or bi-annual reviews can help adjust your rates to remain competitive and profitable, ensuring they accurately reflect your current practice status and market conditions. Decide on a target annual income based on your personal financial goals, professional growth aspirations, and market standards.

Tracking and managing billable and non-billable hours is crucial for professional service agencies, such as consulting, creative, or software development companies. Billable utilization is calculated by dividing the number of billable hours by the total number of working hours available, then multiplying by 100 to get a percentage. Tracking work hours helps freelancers and agencies manage time efficiently, invoice accurately, and analyze productivity. For example, a marketing agency that creates campaign strategies or analyzes marketing data for client projects would count these hours as billable.