Performing regular bank reconciliations is key to keeping on top of your company’s financial health and paving the way for sustainable business growth. When performing a bank reconciliation, it is important to ensure that all 7 ways you can send irs payments transactions are recorded accurately in the accounting records. A bank reconciliation statement is a document that compares the cash balance on a company’s balance sheet to the corresponding amount on its bank statement.

How to Prepare a Bank Reconciliation

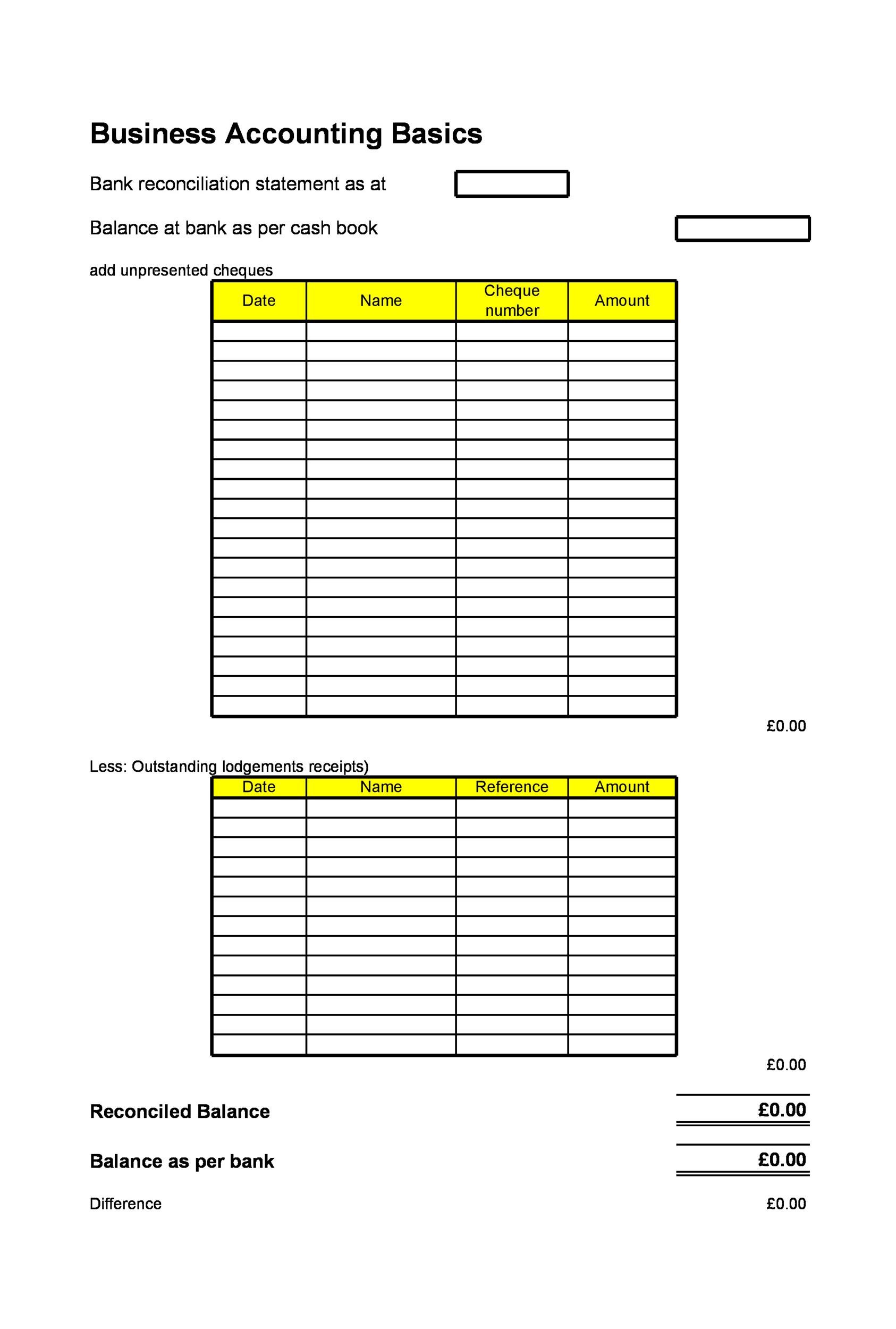

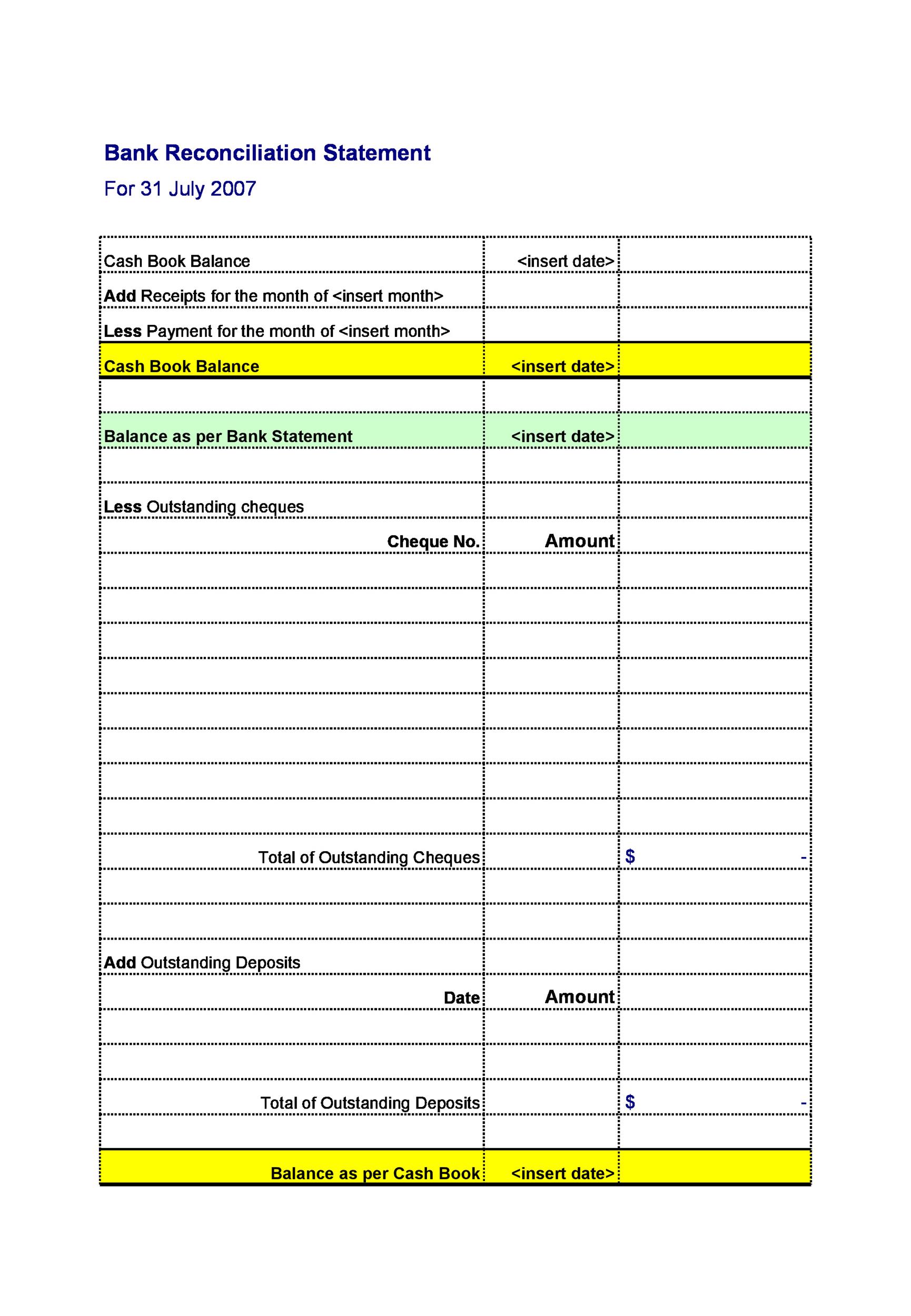

It involves comparing the company’s bank statement with its own records to identify any discrepancies and reconcile them. Bank reconciliation is a process that helps individuals and businesses ensure that their accounting records match the bank’s records. This process is essential to ensure that the financial statements are accurate and reliable. Outstanding checks (also known as unpresented checks or uncleared checks) are the checks that have been issued by the depositor in favor of a creditor but have not yet been presented for payment by him. The amount of these checks are recorded by the depositor when they are issued but no entry is made by the bank in his account until the checks are actually presented and payment received by the creditor.

Bank Reconciliation Process FAQs

Unpresented checks, therefore, cause a difference between the balance in company’s accounting record and the balance as per bank statement for the period concerned. Reconciling bank statements with cash book balances helps your business know the underlying causes of these balance differences. Once the underlying cause of the difference between the cash book balance and the passbook balance is determined, you can then make the necessary corrections in your books to ensure accuracy. Keeping accurate financial statements is the easiest way to simplify your bank reconciliation process.

Fact Checked

This can include monthly charges or charges from overdrawing your account. If you’ve earned any interest on your bank account balance, it must be added to the cash account. Once you’ve identified all the items that align between the two records, it’s time to account for any discrepancies. These may include deposits in transit, outstanding checks, bank fees, or miscalculations by the bank or the internal accounting team.

You need to make sure that all the deposits you’ve recorded in the books reflect in the bank statement. Match each deposit from the debit side of your record to the credit side on the bank statements while ensuring that the amounts correspond. Consider performing this monthly task shortly after your bank statement arrives so you can manage any errors or improper transactions as quickly as possible. Bank reconciliation statements are effective tools for detecting fraud, theft, and loss. For example, if a check is altered, the payment made for that check will be larger than you anticipate. If you notice this while reconciling your bank accounts, you can take measures to halt the fraud and recover your money.

Is your team struggling with time-consuming bank reconciliation?

- To successfully complete your bank reconciliation, you’ll need your bank statements for the current and previous months as well as your company ledger.

- Your bank may collect interest and dividends on your behalf and credit such an amount to your bank account.

- This can range from one-off errors such as calculation mistakes or double payments to major concerns like theft and fraud.

- Bank reconciliation statements are tools companies and accountants use to detect errors, omissions, and fraud in a financial account.

Therefore, an overdraft balance is treated as a negative figure on the bank reconciliation statement. After adjusting all the above items, you’ll end up with the adjusted balance as per the cash book, which must match the balance as per the passbook. After including all the amounts identified in Step 3, your statements should display the same final balance.

It would essentially create a difference of $500 between the balance in your accounting records and the balance in the bank statement. To create a bank reconciliation, you will need to gather your bank statements and reconcile them with your accounting records (ledger). While reconciling your books of accounts with the bank statements at the end of the accounting period, you might observe certain differences between bank statements and ledger accounts. If this occurs, you simply need to make a note indicating the reasons for the discrepancy between your bank statement and cash book. Typically, the difference between the cash book and passbook balance arises due to the items that appear only in the passbook.

Deposits in transit, or outstanding deposits, are not showcased in the bank statement on the reconciliation date. This is due to the time delay that occurs between the depositing of cash or a check and the crediting of it into your account. Go through both statements and highlight any transactions that appear on only one side. Note that transactions may take a few days to clear, so the transaction date in your financial records may not precisely match the date on your bank statement. Greg’s January financial statement for the company shows $100,000 in cash, but the bank statement shows only $88,000. Let’s take a look at a hypothetical company’s bank and financial statements to see how to conduct a bank reconciliation.

A bank reconciliation statement is a document prepared by a company that shows its recorded bank account balance matches the balance the bank lists. This statement includes all transactions, such as deposits and withdrawals, from a given timeframe. A company’s internal cash balance often differs from its bank balance due to timing, fees, errors, or, in some cases, fraudulent activity. This process helps finance teams resolve these discrepancies, providing a more accurate view of cash flow and safeguarding against misreporting.

Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site. While we strive to provide a wide range of offers, Bankrate does not include information about every financial or credit product or service. After you have compared the deposits and withdrawals, determine any missing transactions. Bank reconciliations are performed at consistent intervals, typically on a weekly or monthly basis.